Employer'S Tax Guide 2025 - Xml (and sgml) files are typically used by publishers and tax professionals. The nation’s top federal tax resource, the u.s. Publication 926, Household Employer's Tax Guide, Xml (and sgml) files are typically used by publishers and tax professionals. The internal revenue service released a draft of the 2025 publication 15, (circular e) employer’s tax guide, on nov.

Xml (and sgml) files are typically used by publishers and tax professionals. The nation’s top federal tax resource, the u.s.

Publication 15B (2019), Employer's Tax Guide to Fringe Benefits, 12 issued an updated employer’s tax guide, effective jan. Instructions and publications xml source files.

Employer'S Tax Guide 2025. Instead, information specific to agricultural employers and employers in u.s. Irs releases publication 15 (2022), circular e, employer's tax guide | tax notes.

The nation’s top federal tax resource, the u.s.

Publication 926 Household Employer's Tax Guide; Household Employer's, 12 issued an updated employer’s tax guide, effective jan. T he new year started with the latest form 941 for 2025 tax year from the irs.

Fed Employer Withholding Tax Chart Hot Sex Picture, 12 issued an updated employer’s tax guide, effective jan. T he new year started with the latest form 941 for 2025 tax year from the irs.

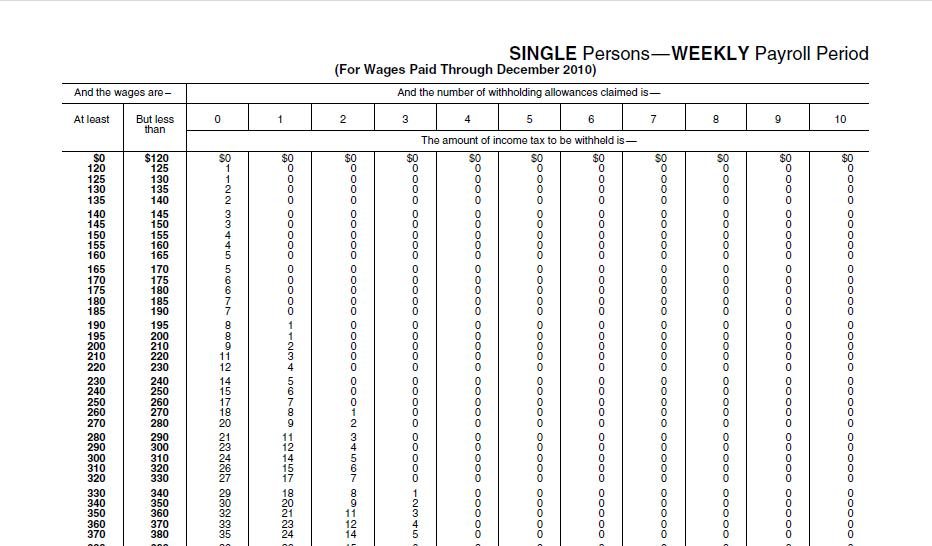

Now, use the income tax withholding tables to find which bracket $2,025 falls under for a single worker who is paid biweekly.

withholding tables Fill out & sign online DocHub, Social security and medicare tax for 2025. All examples in this guide show tax calculated using the tax tables, not the scottish rate or welsh rate tables — you must use the scottish rate tables for an employee with a prefix.

Tax Season 2025 Your Guide to Filing a Tax Return This Year WSJ, ‹ answers to frequently asked questions ‹ electronic filing information ‹ withholding tax tables ‹. Publication 15 (2025), (circular e), employer's tax guide for use in 2025.

Publication 926 Household Employer's Tax Guide; Household Employer's, 20 by the internal revenue service. You report and pay class 1a on these types of payments during the tax year as part of your payroll.

The maximum additional child tax credit amount has increased to $1,600 for each qualifying child.

What Is Medicare And Social Security Tax For 2017, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. Now, use the income tax withholding tables to find which bracket $2,025 falls under for a single worker who is paid biweekly.

Circular E 15T 2021 Federal Withholding Tables 2021, 1, 2025, regarding income tax withholding. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

The nation's top federal tax resource, the u.s.

Tax rates for the 2025 year of assessment Just One Lap, 583 starting a business and keeping records. Now, use the income tax withholding tables to find which bracket $2,025 falls under for a single worker who is paid biweekly.