Tax Brackets 2025 Usa Married Filing Jointly - You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1% increase the 2025 tax year had. IRS Sets 2025 Tax Brackets with Inflation Adjustments, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any.

You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1% increase the 2025 tax year had.

Us Tax Brackets 2025 Married Filing Jointly Irs Drusi Madlen, Here are the 2025 federal tax brackets.

Tax Brackets 2025 Married Filing Jointly Cordi Paulita, 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1% increase the 2025 tax year had.

Tax Brackets 2025 Usa Married Filing Jointly Jessi Lucille, Taxpayers whose net investment income exceeds the irs limit ($200,000 for an individual taxpayer, $250,000 married filing jointly, or $125,000 married filing.

Tax Brackets 2025 Usa Married Filing Jointly Jessi Lucille, Married filing jointly these rates also apply to a surviving spouse.

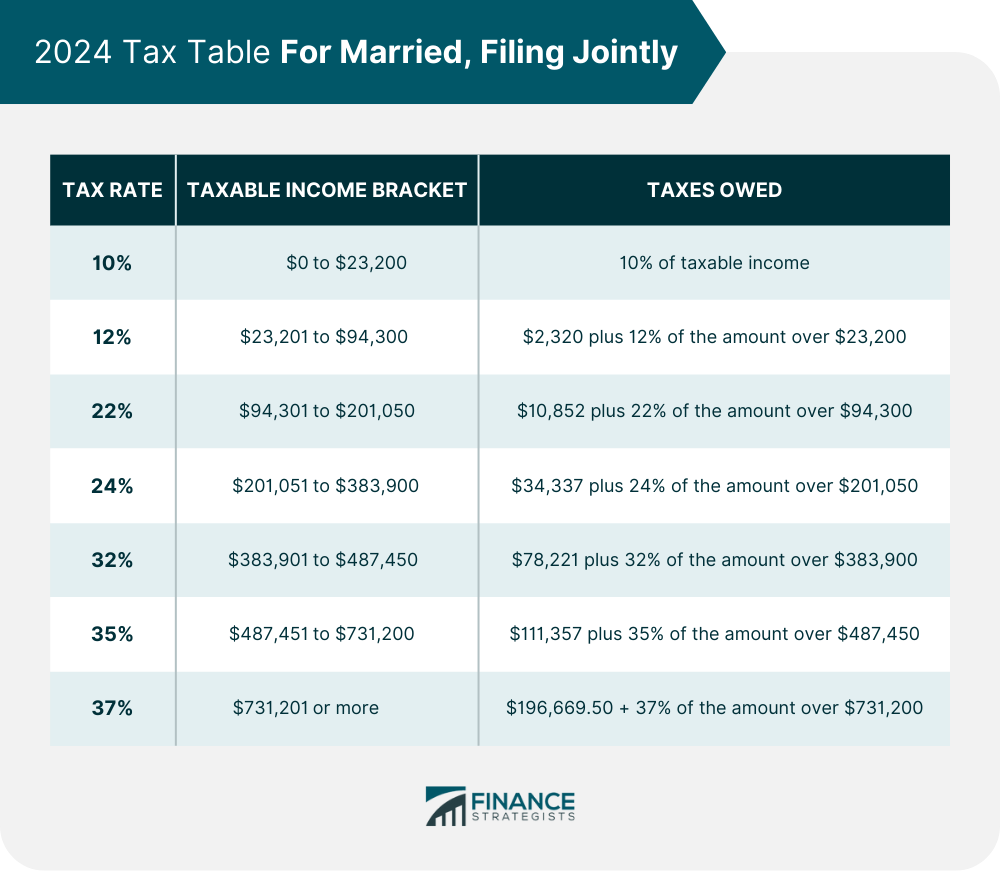

Tax Bracket 2025 Married Filing Separately With Dependents Sella Felisha, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Tax Brackets Definition, Types, How They Work, 2025 Rates, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any.

Tax Brackets 2025 Usa Married Filing Jointly. You pay tax as a percentage of your income in layers called tax brackets. Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they.

2025 Tax Rates Married Filing Jointly Roz Leshia, Here are the 2025 federal tax brackets.

Tax Brackets 2025 Usa Married Filing Jointly Twyla, As your income goes up, the tax rate on the next layer of income is higher.

2025 Married Filing Jointly Brackets Addy Lizzie, Married couples filing jointly enjoy a tax status where they combine their incomes and file a single tax return.